3 min read

All quiet on the surface in currency markets; beware of macro trends

Millennium Global Aug 11, 2021 10:10:00 AM

Large macro divergences have failed to deliver higher FX volatility. Those macro trends include a surge in growth in Q2 from the Covid19 recession and a flare-up in inflation in major economies.

In addition, there has been a differentiated response by central banks, with an early tapering of QE in Canada, New Zealand and Australia and an expected early rate lift-off in Norway.Furthermore, current account balance trends have been diverging with a sharp improvement in Australia, resilient surpluses in the Euro area, but wider or persistent deficits in the US and UK.

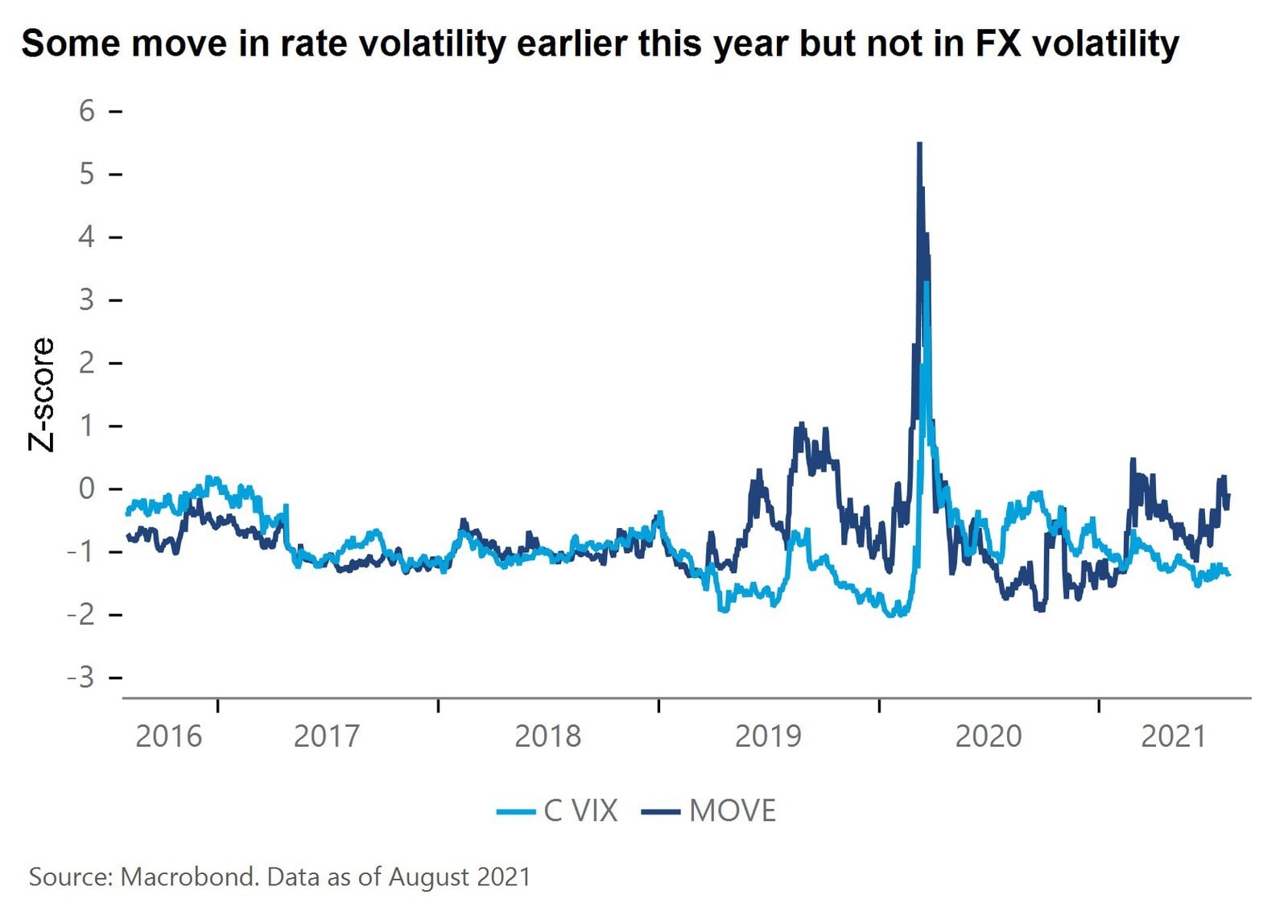

Even as interest rate volatility moved higher earlier this year on US inflation fears, the impact on FX volatility was muted and short-lived.

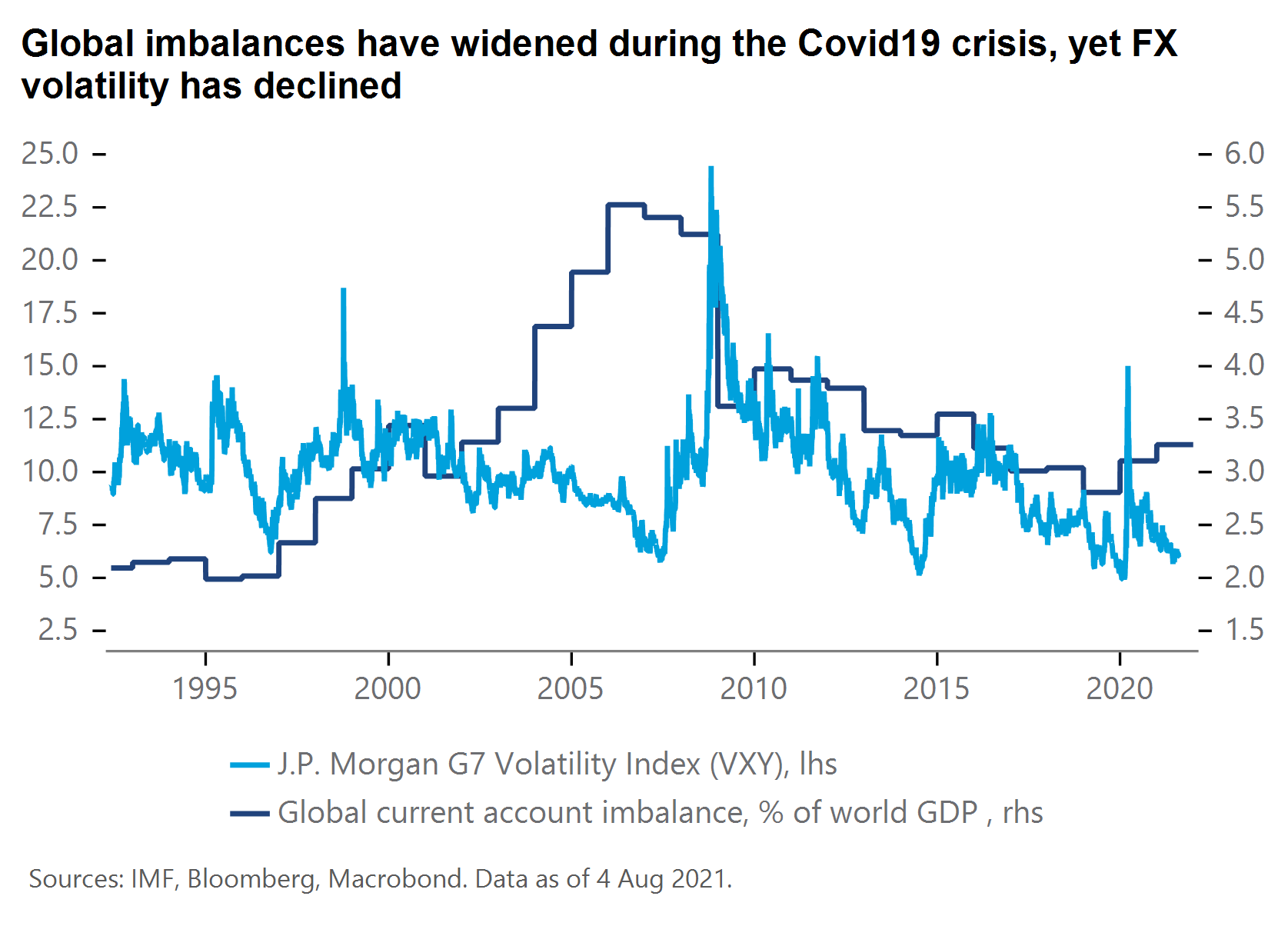

We focus below on one of the traditional macro drivers of currency volatility, namely the dispersion in current account balances. Specifically, global imbalances (defined as the sum of overall current account surpluses and of the absolute value of overall deficits in the world) increased by 0.4% of world GDP during the Covid19 crisis, to 3.2%, according to the latest IMF External Sector Report issued earlier this month.

Contrary to the 2008 Global Financial Crisis (GFC), which resulted in narrowing global imbalances, a synchronised global recession, the differentiated impact of the pandemic across sectors (e.g. travel vs. healthcare or work-from-home related products) and the magnitude of national fiscal policy actions have combined to widen global imbalances. Consider China, which saw its exports benefiting from the pandemic vs. the US, which has launched the biggest fiscal response, boosting both the Chinese current account surplus and US deficit. As seen in the chart below, the currently low FX volatility is at odds with wider global imbalances.

It may be only a question of time before FX volatility increases as unsustainable current account gaps eventually close over time (either excessive surpluses or deficits). In fact, a period of wide global imbalances preceded the 2008 GFC and for years coincided with low FX volatility before unravelling.

History suggests that it usually takes a mix of structural reforms, fiscal policy action and flexibility of currency regimes to reduce external imbalances.

This time around, fiscal policy is unlikely to be a primary driver of the adjustment. This is because the record fiscal response in 2020 to the Covid-19 crisis only helped to compensate for the sharp rise in private sector savings, hence having little impact on the current account balances e.g. the German current account surplus failed to decline even as a large fiscal package was implemented. Therefore, the fiscal consolidation to come over the next few years is unlikely to fully eliminate gaps to sustainable current account balances and could even exacerbate them. Structural reforms aimed at boosting productivity (e.g., through investment in research, education, infrastructure) could play a role over the medium-term as governments in the US, UK or Canada have all outlined multi-year recovery plans involving large public investment but that will take longer to impact external balances. That should leave a big role for exchange rates in the external adjustment over the near term.

According to IMF’s estimates, the current account deficits of the US, UK and Canada are excessive as are the surpluses of Mexico, Poland and Russia. This leaves scope for MXN, PLN and RUB appreciation in real terms over the medium term. With Banxico and Central Bank of Russia displaying a strong commitment to their respective inflation targets in contrast with the National Bank of Poland resistance to rate hikes, real currency appreciation may primarily go through currency spot appreciation in Mexico, Russia but also through higher inflation in Poland.

Excessive current account deficits will likely act as a drag for the US dollar, British pound and Canadian dollar over the medium term. The start in 2022 of a multi-year fiscal consolidation process in the US, UK and Canada should help lower current account deficits and weaken their exchange rates on a trade-weighted basis. But we expect such an external adjustment to be delayed in the near term, as relative growth performance and monetary policy differentiation are likely to provide an offset for the US dollar and the British pound. In 2021 the US economy benefits from the largest fiscal stimulus in developed markets while fiscal support has also remained in place this year in the UK and Canada. With US growth well above trend and the Fed likely to gradually start normalising policy (in our view with QE taper announcement by end-2021 and rate lift-off by end 2022), USD overvaluation (vs. developed markets) may be maintained for some time. US growth exceptionalism keeps foreign equity inflows flowing to the US, thereby funding the current account deficit. The UK’s expected growth outperformance in 2021 versus the G7 and the Bank of England signalling rate hikes by H2 2022 should also insulate GBP from a persistently wide current account deficit in the near term. In that regard, UK’s current account deficit is now unusually fully offset by foreign FDI and portfolio flows. We hold bigger concerns for CAD however, as it has already benefited from Bank of Canada’s early move to taper QE and as net portfolio outflows are recorded, suggesting downward pressure from external adjustment may start earlier for CAD.

Taking on the future: Machine Learning in FX Risk Management

By Justin Gang Xu, Head of Risk The global foreign exchange markets are primarily influenced by a combination of fundamental and market dynamic...