Managing a Currency Programme – The Mechanics

Key Takeaways A specialist currency manager can manage on-boarding, implementation, reporting and monitoring to ensure a currency program can be...

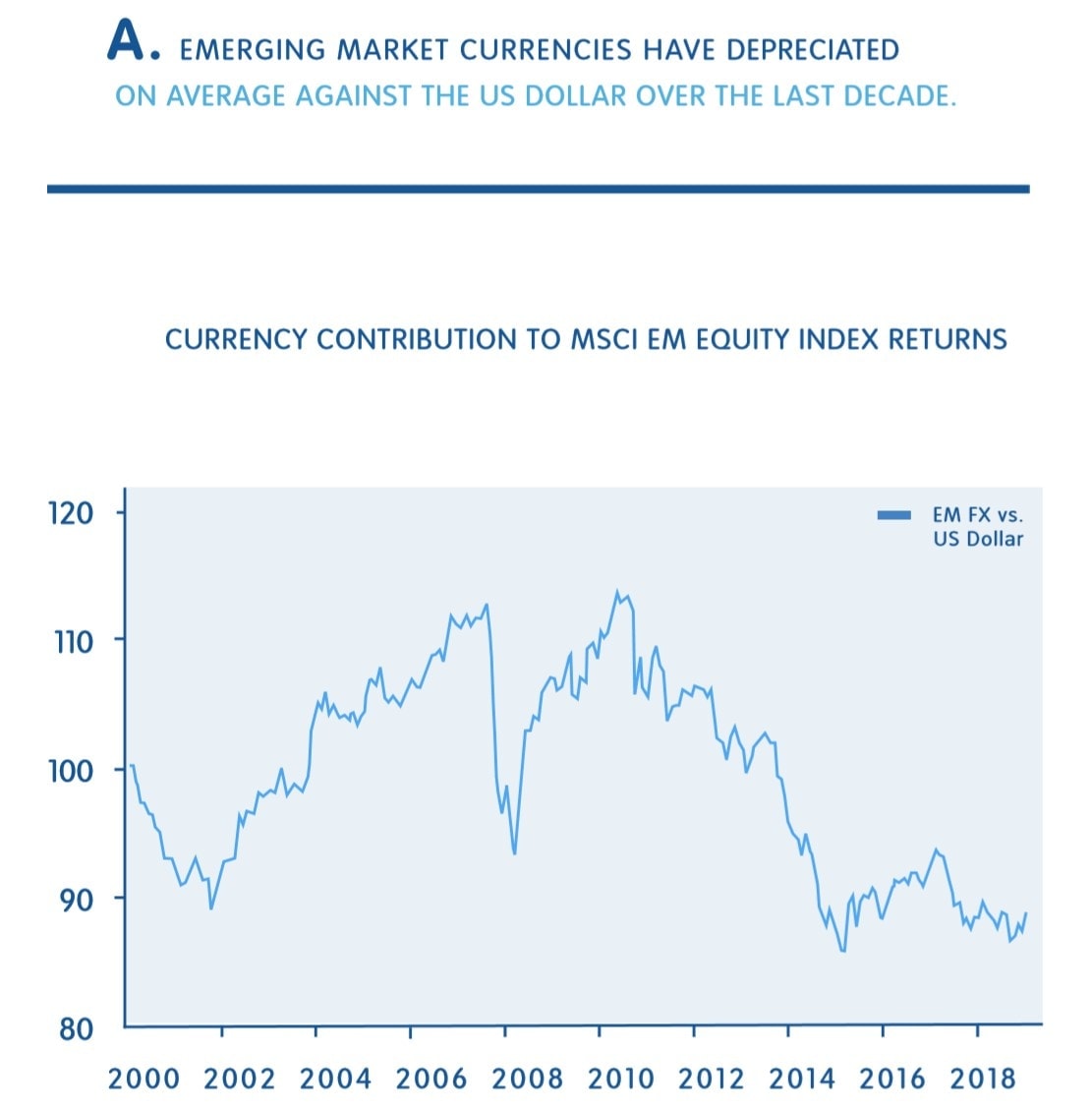

Severe bouts of currency depreciation have periodically caused large drawdowns in EM portfolios.

Investors have often avoided hedging EM currencies because it is seen as too difficult and too costly. This is no longer the case.

Liquidity has grown, interest rates have converged and transparency has increased; all this has brought costs down and made currency management easier.

A Dynamic Hedging strategy is ideally suited to EM currencies as a fixed passive hedge may have a negative impact on returns.

Global investors typically allocate to emerging markets with the aim of benefiting from the growth of developing economies and to improve the diversification of their portfolios. Generally speaking, emerging markets provide higher fixed income yields than those available in developed markets and emerging market equities have often offered cheaper valuations and superior growth prospects than those of developed markets.

Traditionally, institutional investors with portfolios containing emerging market asset exposure have left the emerging market currency exposure associated with it unmanaged.

Historically, there have been 3 assumptions underpinning this view:

Emerging market currencies tend to appreciate in the long term and therefore investors do not need to hedge the currency risk.

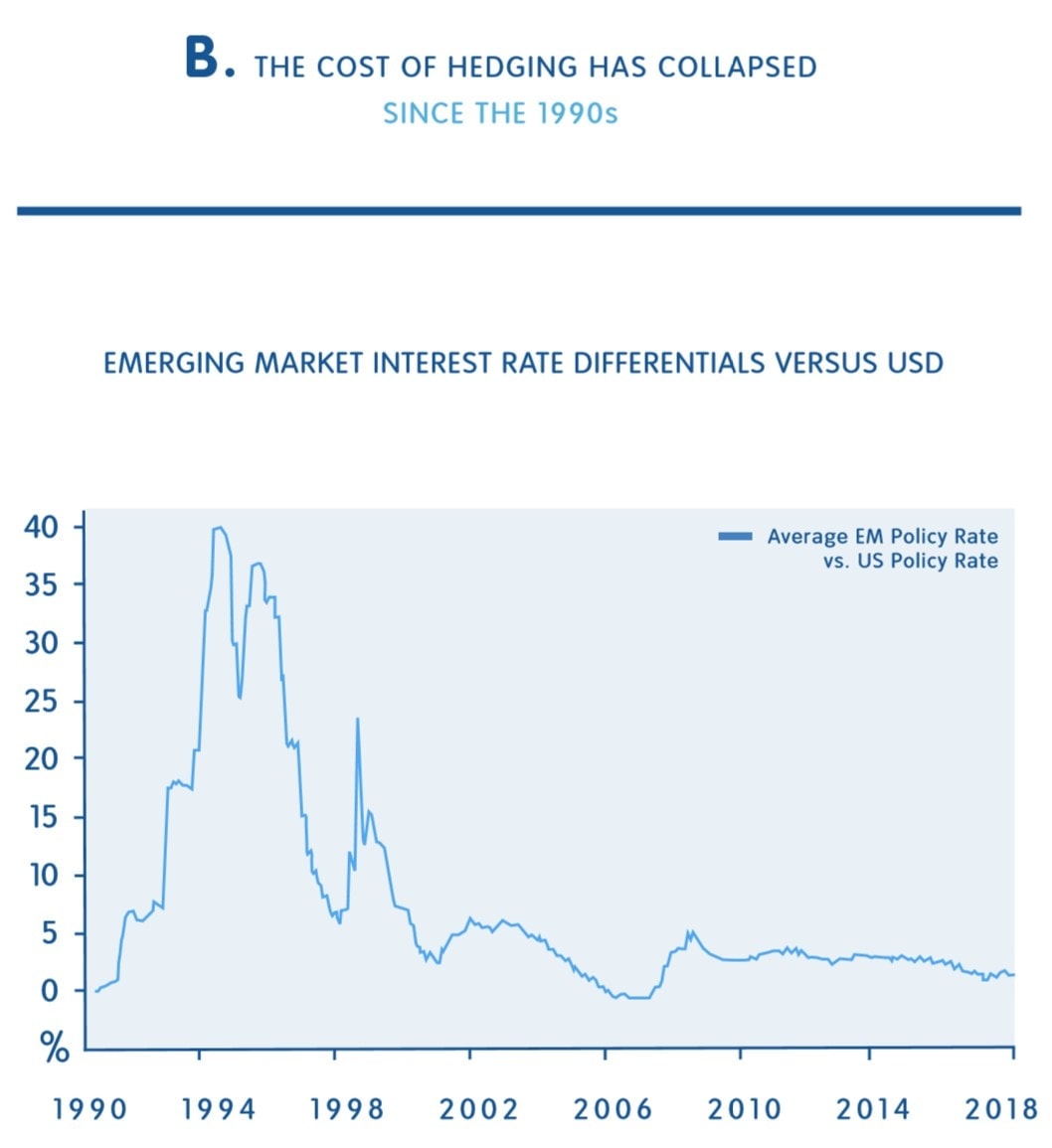

The cost of hedging emerging market currencies is punitively high due to large interest rate differentials versus the US dollar.

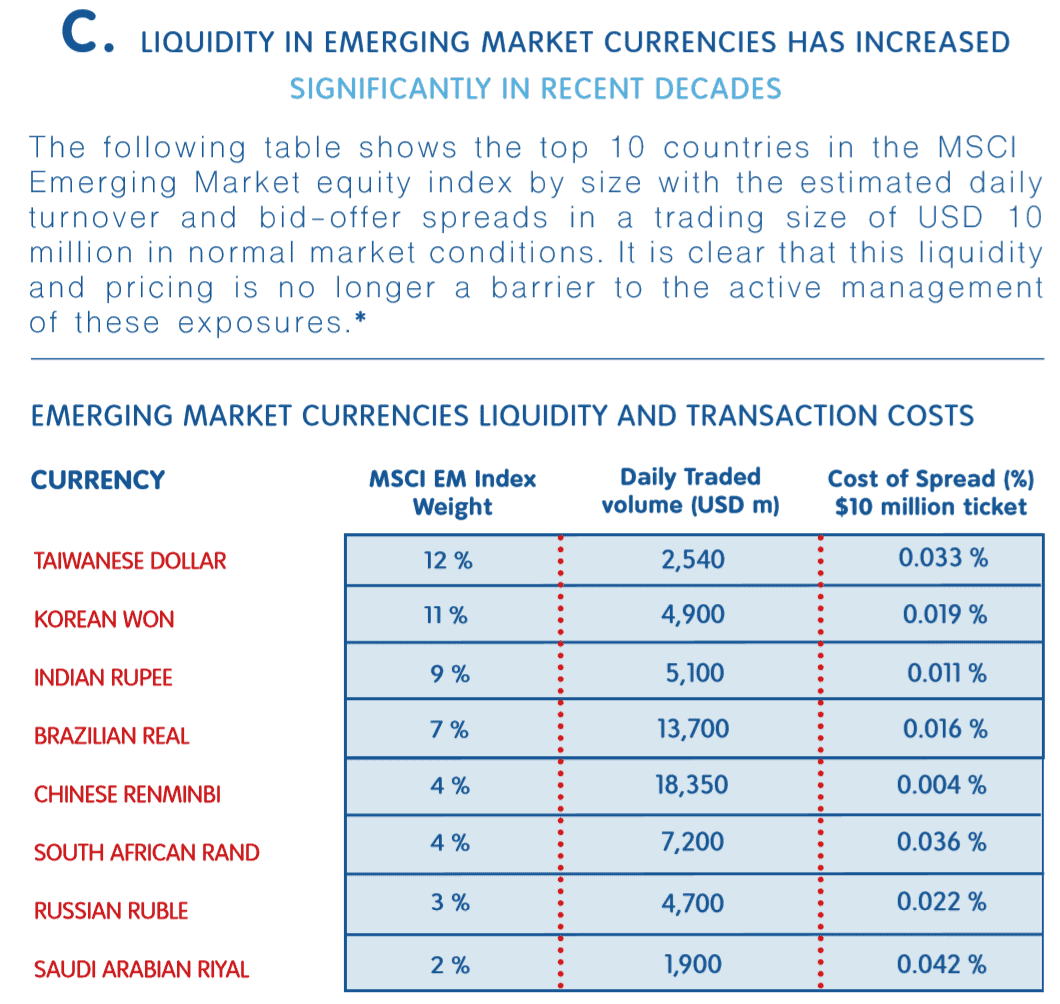

It is unrealistic to try to actively manage emerging market currency risks because of poor market liquidity.

In examining the evidence, it can be shown that each of these claims is false.

Source: Millennium Global and Bloomberg, December 2000 to December 2019. Data sourced on 31 March 2020.

Source: Millennium Global and Bloomberg, December 2000 to December 2019. Data sourced on 31 March 2020.

*Pricing, volumes and spreads do change dramatically in periods of global crisis.

Source: Millennium Global and Bloomberg, December 2000 to December 2019. Data sourced on 31 March 2020.

The consequence of these new realities is that:

emerging market currencies undergo extended periods of depreciation

the interest rate costs of hedging emerging market currency risk are no longer a barrier to managing this risk

increases in liquidity and the reduction in transaction costs now permit the active management of emerging market currency exposures.

Source: Millennium Global and Bloomberg, December 2000 to December 2019. Data sourced on 31 March 2020.

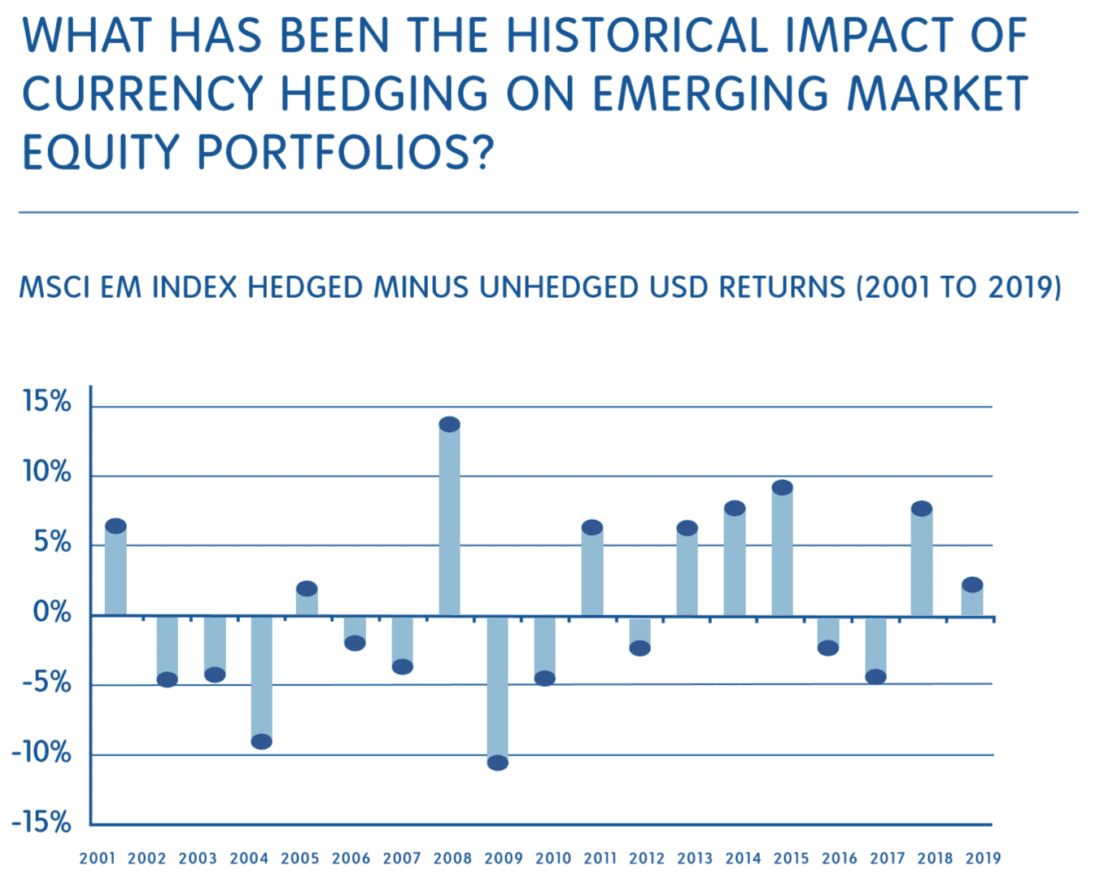

The evidence shows that leaving emerging market currency exposure unhedged on a continuous basis is not optimal even over multi-year periods. Since the Global Financial Crisis in 2008, it would have been beneficial to have EM exposure hedged in 7 of the 12 years up to end-2019.

Given the cyclical nature of currency market trends as evidenced by the historical data, there are times to be exposed to emerging market currencies and there are times to be hedged. Hence, a Dynamic Currency Hedging strategy is ideally suited to managing this exposure.

If you have any questions, please contact us here.

Key Takeaways A specialist currency manager can manage on-boarding, implementation, reporting and monitoring to ensure a currency program can be...

Currency management can be complicated and investors sometimes find them difficult to understand.Millennium Global has created a short animation that...

Key Takeaways The impact of currency exposures on international investments can be large in both return and risk terms. History is filled with...