3 min read

Emerging Market FX: Global versus Domestic Factors

Millennium Global Feb 15, 2021 10:09:00 AM

US and global growth expectations have been revised higher but with rising US Treasury yields, could that end up as a mixed bag for EM currencies, as a large fiscal expansion unfolds in 2021 in the US?

To answer this question, we ran an update of our Principal Component Analysis (PCA) methodology which helps assess the impact of the global environment on EM currencies.

EM currencies overall are not yet fully discounting the prospect of global growth recovery or rises in commodity prices and a number of EM currencies display very cheap valuations. The case for EMFX remains strong but differentiation has increased. In EM economies where rising inflation combines with increased sovereign risk, we see currencies as particularly vulnerable to higher US Treasury yields.

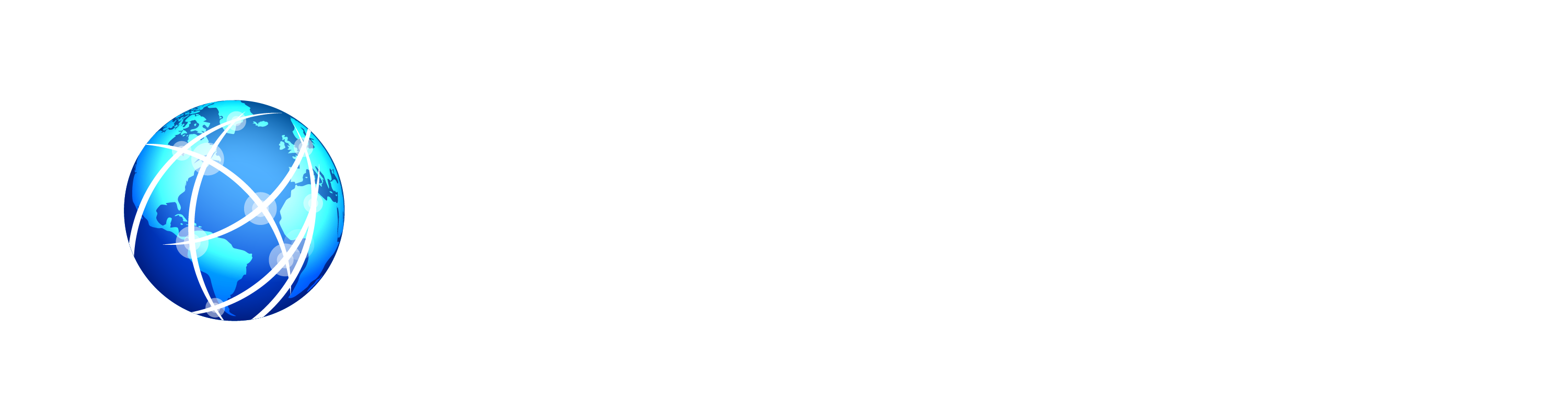

On our measures, the Turkish Lira (TRY), which is so far the best performing currency year-to-date, has strengthened more vs. US dollar than could be justified by global factors* (see chart 1). Additional TRY gains likely rely on further improvement in domestic fundamentals, including the curbing of inflation and reducing the dollarization of residents’ deposits. The commitment of the Central Bank of Turkey to a tight monetary stance has been the first step. We believe this could be tested by the need to raise rates, as inflation has yet to peak in view of pipeline pressures reflected in PPI data.

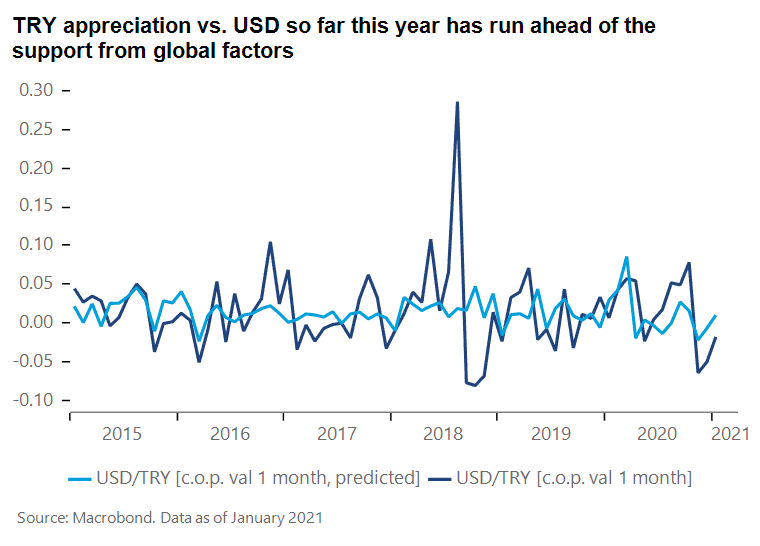

The Brazilian Real (BRL), currently the worst performing EM currency year-to-date, is under-pricing the positive impact from the global environment (see chart 2), mostly commodity prices. Upside surprises on inflation have acted as headwinds for BRL and they combined with heightened uncertainties surrounding the fiscal outlook, mainly related to the pandemic. Progress in containing the virus spread and early tightening of monetary policy as soon as May could provide domestic catalysts for a BRL rebound closer in line with global factors, including commodities.

Indian Rupee (INR) is in line with global factors which leaves it firmly driven by the fine balance between growth support and financial stability. That remains a net positive for INR at this stage in our view, as the Reserve Bank of India (RBI) keeps the inflation targeting system intact while accommodating fiscal expansion. But with our estimate that USD/INR is in line with what is implied from global factors, this leaves little buffer for a deterioration in domestic fundamentals (for instance a premature cut in policy rates).

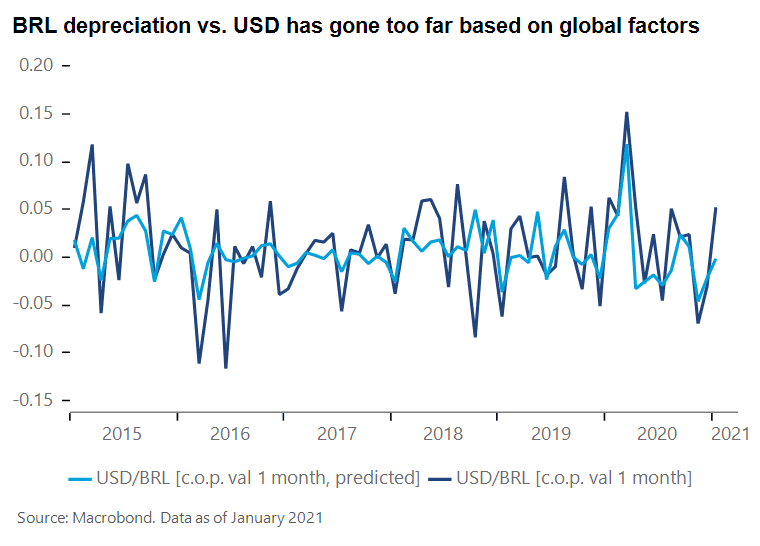

The Korean Won (KRW) has underperformed other EM Asian currencies year-to-date, reflecting large resident equity outflows. We find that this now leaves KRW vs. USD at a significant discount compared to global factors (see chart 3), making it attractive at a time when strong demand and high prices for semiconductors benefit Korean exports.

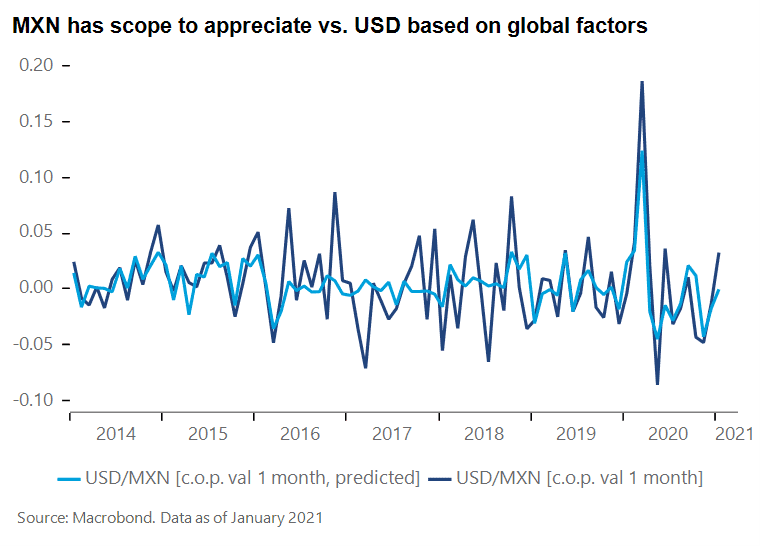

Another highly cyclical EM currency, the Mexican Peso (MXN) has also lagged the improvement in global factors, based on our PCA analysis (see chart 4). While a headwind for growth, the restrictive monetary stance of Banxico, combined with a large trade surplus, points to MXN gains vs. USD ahead.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

*Global factors include equity and credit markets, commodities, USD index, US Treasury bonds.

If you have any questions, please contact us here.

Keywords: EMFX, currency management, EM currencies, inflation, pandemic.

Important Disclosures:

This document contains the views and opinions of Claire Dissaux as of 12 January 2019 and does not necessarily represent the opinions of Millennium or the funds/accounts it manages or of any Portfolio Managers.

Nothing in this document should be construed as an offer, solicitation, invitation, marketing of services or products, advertisement, inducement, or representation of any kind, or as an opinion on the merits or otherwise, of any particular investment, investment strategy or market in which to invest. Any examples of Strategies or trade ideas are intended for illustrative and/or educational purposes only, and are not indicative of the historical or future Strategy or performance or the chances of success of any particular Strategy.

The views and opinions in this document are not guaranteed nor intended to be complete, and material aspects of the descriptions contained herein may change at any time. Neither Millennium Global, nor its portfolio managers, nor any of its employees will be held responsible for any error or omission and/or any claim, loss, damage or inconvenience caused as a result of reliance on information contained in this document.

Past performance of any strategy shown herein is not a guide, and should not be construed as a guarantee of future performance as the value of any Strategy or investments may fall as well as rise, and an investor may lose all or a substantial amount of their investment.

Certain portions of the information contained in this document may constitute forward-looking statements, views or research opinions. Due to various uncertainties and actual events, the actual performance of the economy may differ materially from those reflected or contemplated in such forward-looking statements, views or opinions. As a result, investors should not rely on forward looking statements, views or opinions in making any investment decisions.

There can be no assurance that any investment opportunities described in such models will become available to any Strategy or to Millennium Global. URN 103870

Taking on the future: Machine Learning in FX Risk Management

By Justin Gang Xu, Head of Risk The global foreign exchange markets are primarily influenced by a combination of fundamental and market dynamic...